This article was originally published by The Fix and is republished here with permission. Learn about the latest from the world of European media by signing up for their newsletter.

War fatigue hit Ukrainian, Russian and war-focused media in November, according to recently published Similarweb data. Blackouts in Ukraine and changes to social media algorithms likely added to headwinds faced by publishers.

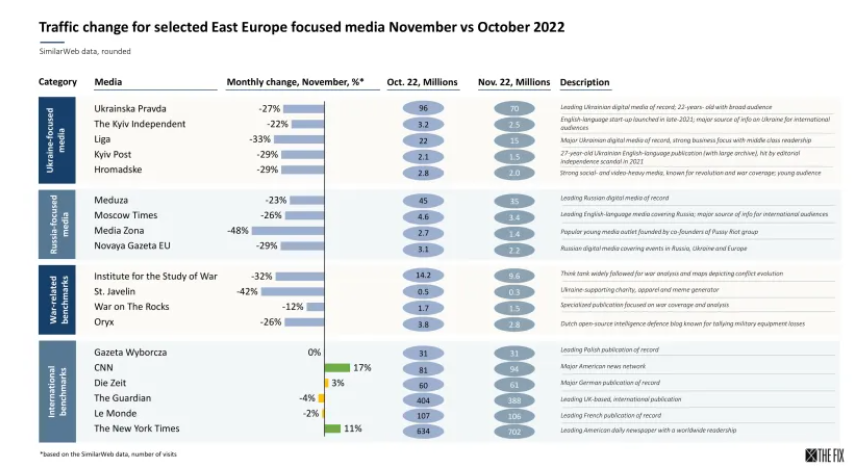

Ukrainian and Russian media reviewed by The Fix were hit by almost 30% average drops (see selected examples below). Media focusing on war coverage, as well as social initiatives related to the war, saw similar declines.

This is less than the consecutive double-digit drops in March-June, when traffic dropped from the stratospheric levels of February-March (back then leading Ukrainian publisher Ukrayinska Pravda had half a billion views on the website). Still, since June-July most publishers have regained traffic with consistent, month-over-month growth through to October.

Hence, the November decline is a worrying sign. On the one hand it underscores the level of exhaustion of local audiences and challenges media companies to find new ways to keep global audiences’ attention.

It also raises concerns about the impact of blackouts across Ukraine and the capacity for media to continue to deliver critical information to affected audiences. On an international level, it raises questions about the potential impact of social media, especially Twitter, downgrading the war in their algorithms.

Audience exhaustion, war turns less spectacular

The hypothesis that traffic is down due to the World Cup, raised by some media managers, seems rather unlikely. If audiences were really tuning out to watch football on TVs or streaming services, you would expect to see noticeable declines among global media.

Instead, traffic figures for Le Monde – a leading publisher in France (widely seen as a favorite to win the cup) – took just a slight 2% hit. A look at international publications, including CNN, Die Zeit, The Guardian and Gazeta Wyborcza shows either minor declines or even growth for the US publications (likely driven by the mid-term elections).

The more likely tale is one of audience exhaustion (i.e. audiences in various countries gradually tune out, distracted by local celebrity scandals, elections or natural disasters) and a shift towards a less captivating, visually spectacular phase of the war. The latter is all the more likely given that the decline has been similar among media covering the war for both regionally based and international audiences.

Earlier phases of the war were arguably the most engaging, diverse and visually stunning footage of a 21st century conflict.

To recap, here’s just a few things we have seen: attempted WWII-style blitzkrieg taking of cities, a spectacular failure of this strategy (i.e., the “blyatskrieg”), the first mass drone war, the first TikTok war, waves of Russian ammo depots blown up by HIMARS, the Kerch Strait bridge explosion, Russian settlers and tourists fleeing Crimea, lots of animals (leading to the whole “Ukrainian soldiers as Disney princesses” micro-trend), tractors stealing tanks and air-defense systems, helicopter raids to blow up fuel depots in Russia, The Ghost of Kyiv, the Kharkiv counter-offensive, Nord Stream explosions… (and this is an incomplete list!)

It’s hard to keep up with such a level. Throughout the past 9 months the war has been dynamic both in terms of types of warfare and positioning (the Institute for the Study of War, best known for its maps depicting changes on multiple fronts, saw basically continuous, steady traffic growth from March with 7.5 million sessions to 14.2 million in October, according to Similarweb data).

This makes the coming months all the more dangerous. Experts predict the fighting to freeze or become more positional over the winter, with a major revival expected in the spring. In practice that means months during which audiences disengage.

Undoubtedly, this is part of the Russian strategy – wait till Western audiences lose focus, struggle with cost of living issues, and push / let their leaders try to force Ukraine to make compromises. For publishers, it will require innovation and creativity to keep audiences engaged.

Blackouts, social media changes add to publisher headwinds

War fatigue is almost certainly not the only factor playing a role. Russia’s campaign of targeting civilian infrastructure in Ukraine – especially the electrical grid – has kept large parts of the country in the dark throughout November.

This has certainly impacted traffic for primarily Ukraine-based media. In past months Russia has sent hundreds of missiles and kamikaze drones against Ukraine’s electricity grid, causing internet availability to drop by up to 65%. Attacks over the weekend have left over a million in Odesa region alone cut off. Neighboring Moldova – strongly integrated into Ukraine’s grid – has also suffered blackouts.

The blackouts in Ukraine have likely also impacted independent Russian media. Despite the war, Ukraine is still the third biggest market for outlets like Mediazona or Meduza (accounting for about 7% of visits).

The turmoil at Twitter is also likely having an effect. Since billionaire Elon Musk took over the platform – a key forum for discussions about the war – hundreds of thousands of users have left or had their accounts suspended (close to 1.4 million between Oct. 27 and Nov. 1 alone, according to tracking firm Bot Sentinel).

Perhaps more worryingly, several notable Ukraine-focused commentators have complained about the reach of their posts dropping by 50% or more. Euan McDonald, editor-at-large of the English edition of major Ukrainian outlet NV, raised the alarm, noting that “Twitter appears to shadow ban Ukraine content” in response.

It is hard to predict how Twitter will evolve. The company is in the middle of an upheaval and it is unclear whether the changes people see in their timelines are planned or simply the result of random people being fired throughout the company.

What is clear is that this will be a demanding winter for media managers to diversify their distribution risks, come up with creative, engaging storytelling formats, and find ways to provide important information to audiences.